Unleashing Financial Freedom: The Path to Success with Finance Services

Are you striving to unlock the doors to financial freedom and pave your path to success? With the ever-evolving landscape of finance services at your disposal, achieving your goals and aspirations has never been more attainable. Finance services encompass a wide array of tools and resources designed to empower individuals and businesses to make informed decisions, optimize financial performance, and secure a stable future. By leveraging these services effectively, you can navigate the complexities of the financial world with confidence and precision.

Whether you're looking to grow your wealth, secure your financial well-being, or plan for a promising future, finance services offer a comprehensive suite of solutions to support your objectives. From investment planning and wealth management to budgeting and retirement strategies, these services cater to diverse needs and priorities, ensuring that you have the resources and expertise necessary to make sound financial decisions. With the right guidance and knowledge, you can harness the potential of finance services to enhance your financial health, achieve your goals, and embark on a journey towards lasting success.

Types of Finance Services

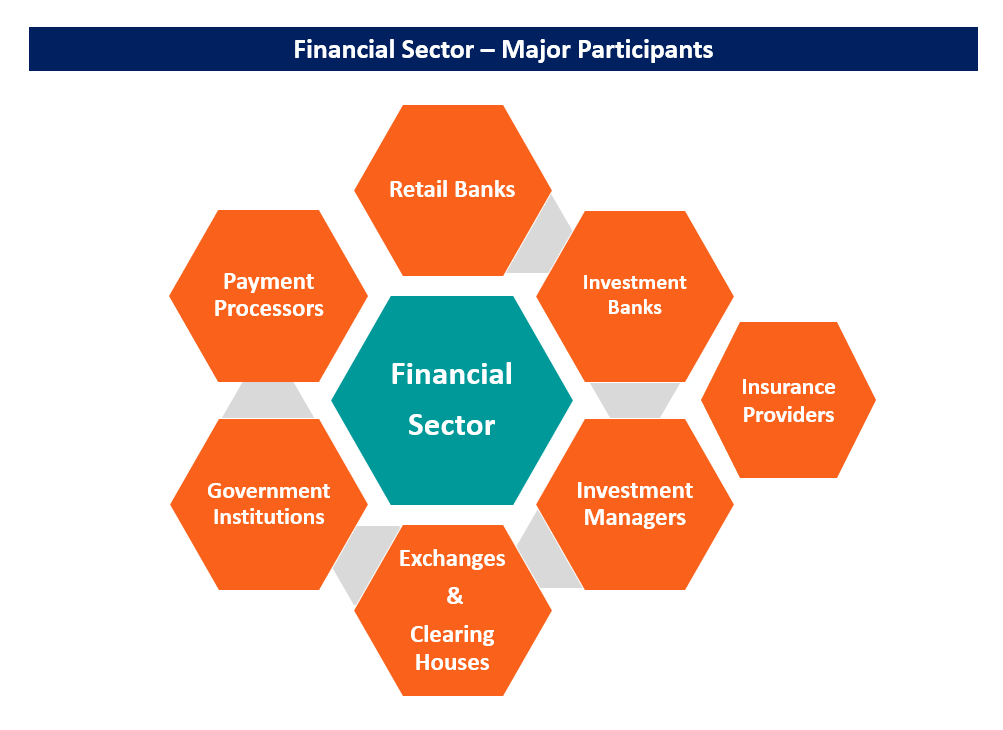

When it comes to finance services, there is a wide range of options available to cater to various needs and goals. Some of the common types of finance services include banking services, investment services, and insurance services.

Banking services encompass a multitude of offerings such as savings accounts, checking accounts, loans, and credit cards. These services provide individuals and businesses with the necessary tools to manage their money effectively and efficiently.

Investment services focus on helping individuals grow their wealth by offering products like mutual funds, stocks, bonds, and retirement accounts. These services aim to create opportunities for long-term financial growth and security.

Insurance services play a crucial role in safeguarding individuals and businesses against unforeseen risks. Products such as health insurance, life insurance, property insurance, and liability insurance provide financial protection and security in times of need.

Benefits of Utilizing Finance Services

When it comes to managing your finances effectively, utilizing finance services can provide valuable expertise and guidance. These professionals have a deep understanding of the financial landscape and can offer tailored advice to help you make informed decisions.

One of the key benefits of finance services is the opportunity to optimize your financial strategies. Whether it's creating a budget, investing in the right opportunities, or planning for retirement, these services can help you maximize your resources and work towards your long-term financial goals.

Additionally, working with finance services can offer peace of mind knowing that your financial matters are being handled with precision and care. By entrusting your financial management to experts, you can focus on other aspects of your life with the assurance that your money is in capable hands.

Strategies for Financial Success

First, it is essential to create a clear and realistic budget that outlines your income and expenses. By tracking your finances diligently and identifying areas where you can cut back on unnecessary spending, you can free up more money to invest in wealth-building opportunities.

Secondly, take advantage of financial services such as investment accounts and robo-advisors to grow your wealth over time. By diversifying your investments and staying informed about market trends, you can maximize your returns and secure a more stable financial future.

Lastly, prioritize building an emergency fund to protect yourself from unexpected expenses and financial setbacks. By setting aside a portion of your income regularly, you can ensure that you have a safety net to rely on in times of need, allowing you to stay on track towards achieving your financial goals.